We live in a very materialistic world. From commercials and advertising to peer pressure to our human ‘wants,’ it can be very difficult to save money. It is never too early to teach our children basic money lessons. So, in today’s post, we will be talking about 6 Basic Money Lessons to Teach Young Children.

To help support our blogging activities, our site contains affiliate links. If you make a purchase from a link on our site, we may receive a small percentage of that sale, at no extra cost to you. Blessed Beyond Crazy is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

Anyone who lives on a farm knows that there is always work to be done. Feeding and watering livestock, working in the garden, gathering eggs, cleaning out the chicken coop, pulling weeds, etc… This was my childhood. During those formative years, I didn’t comprehend the valuable life lessons that I was being taught. Now, over 50 years later, I do. I was one of the lucky ones. I grew up in a home where my parents taught me valuable lessons at a young age. I was taught the value of hard work, honesty, respect for my elders, honoring God and country, living a frugal lifestyle, do not try to keep up with the ‘Jones’, and many, many more valuable lessons… too numerous to list in this single post. Looking back, I am so thankful and blessed to have had the parents and upbringing that I had.

In today’s post, we are highlighting several basic and priceless money lessons that my parents taught me. In turn, I have tried to instill them in my own children, and now in my grandchildren.

1) IT STARTS WITH YOU

The very first step is to realize that YOU are your child’s main teacher. Your children watch you. They are like little sponges that soak up everything; even when you think they are not paying attention. They mirror and reflect what you do. If you have a blase, or indifferent, attitude toward your finances, then chances are your children will have a “devil-may-care” attitude towards their finances too.

You need to be honest with yourself. When you look in the mirror, do you see someone who uses wisdom when it comes to your own personal finances?

- Do you live paycheck to paycheck?

- How about an established savings account and/or a cushion for emergencies?

- Are large amounts of debt and outstanding credit card bills hanging over your head?

- Do you pay your bills on time, all of the time?

- Can you be patient with self-gratification and save up for those items that are a ‘want’ and not a ‘need’ or do you go into debt for frivolous things?

- Is tithing/giving important to you?

Whatever your attitude is towards money; it will more than likely be the attitude that your children hold as well.

2) CHILDREN MUST BE INVESTED

One of the key ways to help children realize the value of money is to give them hands-on interaction with money at a young age. Start by giving your child age-appropriate tasks around the house. Some tasks should be performed simply because they are part of the family, however, try to create a few ‘extra tasks’ where they can earn money. Let them earn it, spend it, donate it, save it and invest it. When children have their own ‘blood, sweat, and tears involved, they have a better understanding of what it takes to make money. It also helps them understand the value of working hard and they usually think twice before spending their own hard-earned cash. Invest in a piggy bank with divided slots for saving, spending, donating: Money Savvy Pig – Blue or Moonjar Classic Moneybox: Save, Spend, Share

3) GIVING

There is balance in everything, however, there is truly something ‘magical’ about giving to others. It’s an act of selflessness and it’s an act of obedience to God’s Word. Whether you believe in tithing or not, the act of giving helps a child to realize that the world doesn’t revolve around them. It also helps a child develop compassion for others less fortunate. Never underestimate the power of giving to others.

Here is a children’s book called Three Cups which is the story of one family’s unique and effective method of teaching personal financial management—and how one boy reaped first the small, then the immeasurably great rewards of the lessons he learned. The Berenstain Bears’ Trouble with Money is another excellent book for children.

4) NEEDS VS WANTS

It’s easy for us to get caught up in this world of instant gratification and teaching our children to wait can be tough. However, it is imperative that we teach our children the difference between an actual ‘need’ versus a ‘want’. There’s a big difference between the two.

As parents, it’s our job to teach our children the word “No.” If you always hand over money to your child for every little whim that they have, then you are not teaching them how to be patient and wait. Help your children plan for what they need and/or want. Help them figure out how much they need to save before they can buy that item they want so badly. Place cash in a clear jar so they can actually see their money stash grow over time. In the end, they may decide that they really do not want that item after all, and if they do purchase it, chances are they will take much better care of it.

5) MULTIPLY SAVINGS

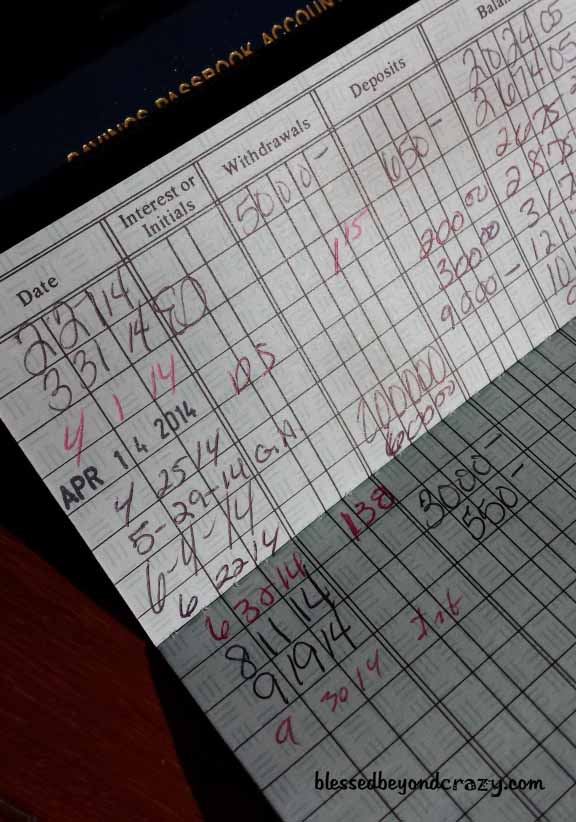

Open a savings account for your child at a local bank. By having their own savings account you are teaching your child important money management elements. These concepts underlie any type of investment decisions they will be made throughout life.

- Teach them how to make deposits/withdrawals. You can show your child deposit and withdrawal slips used for these transactions and how to fill them in.

- Interest – income earned on your money. When a deposit is made in a bank, you essentially are giving the bank the use of your money. In today’s world, the interest in a small savings account is minuscule, however, you are teaching the concept that your money can grow through investments.

- Safety – by placing their money in a bank, their investment is safe.

- Liquidity -your child can take the money out of their savings account at any time, and there are no penalties for doing so.

6) TECHNOLOGY

Take advantage of technology. The Internet is full of age-specific money games for children that make learning about money fun and exciting.

There are several fun games you can download from the Treasury Direct Kids website.

Don’t discount board games such as The Game of Life and Monopoly.

Installing basic money principles into your children while they are young is so important. As a result, those sound money principles will help them to make wise financial decisions for the rest of their life. It’s never too early to start.

Linda

More great ideas:

Ester Perez says

Blessed Beyond Crazy says

Gladys Goforth says

Blessed Beyond Crazy says